Growth Handbook (Pricing)

[Note: This post is a chapter of our Growth Handbook, a guide on organic growth for search funds and mid-market operating executives.]

Pricing Optimization

Warren Buffett has said the single most important decision in evaluating a business is pricing power. Search-CEOs naturally target companies with meaningful market power, and the opportunity for EBITDA growth through pricing optimization is widely-appreciated in the search community. Pricing optimization is a common initial lever for driving profitable growth because if done right, it can translate into a nearly-immediate increase in free cash flow. Plus, if a company’s pricing strategy is flawed, increasing lead generation or sales outreach will anchor customers to a model that may become more difficult to shift later, so the order of operations matters.

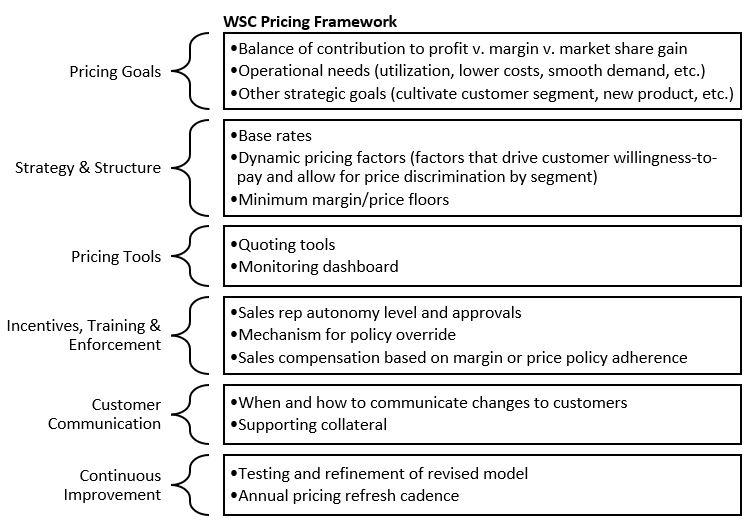

The difficulty, however, is in unpacking a generalized desire to “optimize pricing” into the specific components of a pricing program to isolate what needs to be done. We offer the below framework for attacking the problem:

Key Principles

- The basic goal is to align your prices with customer willingness-to-pay (i.e., shift to value-based pricing)

- Often that requires segmenting your customers into different buckets and charging them different amounts (perhaps indirectly) based on that willingness-to-pay and value created

- These segments can be based on static customer company features like size and industry or situational factors like lead time, size of order and other properties

- Thus, pricing connects back to having a clear understanding of personas and pain points solved

- Many pricing optimization efforts fail at the “last mile” of execution—getting sales people to follow the pricing plan

- The fear of losing an order entirely often outweighs the perceived personal benefit of extracting an extra few points of price

- For instance, if a hypothetical sales person is paid based on a commission of ~5% of revenue, getting a 2% increase in price translates to an immaterial increase in pay for her, which can cause excessive conservativism in pricing (from the standpoint of the company)

- For most businesses, focusing on incentives, training and psychology (of both customers and your sales people) is more important to a pricing program’s success than raw quantitative analysis

Pricing Optimization Project Plan

Each pricing optimization initiative will vary, but the steps below broadly apply to anyone running a pricing project at a mid-market company–particularly a B2B service company.

- Project Setup

- Align internally on goals with leadership team

- Assemble working group: it’s very helpful to have representation across departments if possible because internal buy-in is critical and these people will be your champions

- Internal Pricing and Margin Analysis

- Review your offerings at a product/service level to see margin by category

- Shows if any offerings are not profitable (low-hanging fruit)

- Shows where you have room to cut price, if appropriate, though in most cases lower mid-market companies should be increasing prices

- Look at changes in prices over time

- Have they kept up with inflation?

- Compare versus COGS

- Unfavorable shifts in revenue mix?

- Consider utilization, staffing and other ops factors

- Example 1: Consistent shortages in key roles? May need to bring supply/demand of labor into balance with price change or nudge revenue mix toward offerings that don’t require those roles

- Example 2: Peak demand on certain days causing warehouse capacity issues? Charge more for those days

- Review your offerings at a product/service level to see margin by category

- Customer Economics and Willingness-to-Pay

- Develop hypotheses

- What are (a) customer objectives and (b) the price of their perceived Next Best Competitive Alternative (NBCA)?

- Differentiation value: what value do we add beyond NBCA? (quantify this; consider cost, revenue, risk and psychological value)

- Segment customers and quantify potential pricing factors: what specific factors influence customer willingness-to-pay? These could be attributes of the company or the individual decision maker or the job/offering itself; possible factors include:

- Company: size, industry, geography

- Decision-maker: role, years of experience, has solicited multiple bids?

- Job/Offering: lead time, day of week, total size

- Conduct interviews

- Current customers

- Cost of failure and alternatives

- Decision-making process; threshold where another person approves?

- Representative buyers (expert interviews)

- Current customers

- Competitive research

- Internet / desk research

- Secret shopper

- Expert calls

- Develop hypotheses

- New Model Development

- Revise base rates

- Revise/implement dynamic pricing factors

- Socialize internally and get feedback

- Tool Development

- Create quoting tool: ideally integrated into CRM

- Monitoring dashboard: show both sales rep pricing policy adherence (i.e., are we following the plan) and impact (sales conversion rate and gross profit won per quote)

- Communication

- Internal

- Cascade communication down from sales leads to frontline reps

- Leverage the members of your working group to communicate key points (i.e., create peer validation)

- Show sensitivity of how the business can lose volume and still gain EBITDA

- External

- If sold via custom quotes, may not be necessary to announce price change

- Bundle announcement of rate increase with new value-add or at least announcement of quality/reliability milestone (i.e., error-free rate, safety rating achieved, etc.)

- Expect pushback and don’t lose nerve if a few customers balk

- Internal

- Testing, Monitoring & Refinement

- Clarify how much volume you can lose (or need to gain) while still achieving positive outcome from price changes

- “Gross profit won per quote” is a good metric to follow that considers price captured and impact on sales conversion rate, while normalizing for variance in quote volume

- Hold regular calls with sales leads and project team; review dashboard and solicit qualitative feedback from reps

- Adjust pricing model where needed

- Schedule minimum of once/year review of prices

Note: in some cases it will be necessary to revisit the sales incentive plan and make adjustments as part of a pricing optimization initiative, emphasizing gross margin, pricing policy adherence or other goals

Illustrative Dynamic Pricing Model Template

Further Reading

- The Strategy and Tactics of Pricing – Thomas Nagle, John Hogan and Joseph Zale

- Confessions of the Pricing Man – Herman Simon